Kansas health insurance options are characterized by a range of unique features that reflect the state’s demographics, healthcare needs, and regulatory environment.

One of the defining aspects of Kansas health plans is their diversity in provider networks, which can significantly influence the cost and accessibility of care.

Particularly, rural areas may face limited choices in healthcare providers, leading many residents to rely on a few hospitals and clinics.

In contrast, urban centers like Kansas City and Wichita offer a more extensive range of hospitals, specialists, and ancillary services.

This geographical disparity emphasizes the importance of evaluating not just the plan’s premium costs but also the network coverage and the proximity of healthcare services relevant to individual needs.

Furthermore, Kansas has implemented specific mandates relevant to the health insurance market, such as protections for those with pre-existing conditions and maternal health mandates that ensure coverage for pregnancy-related services.

Kansas residents can also benefit from various public assistance programs that cater to uninsured and low-income individuals.

These include the Kansas Medicaid program known as KanCare, which covers low-income adults, children, pregnant women, and those with disabilities.

Understanding these unique aspects can empower residents to make informed choices about their health insurance needs that align well with both personal circumstances and state regulations.

Page Contents

How Kansas Laws Shape Your Coverage Options

Source: cibc.com

The laws governing health insurance in Kansas play a pivotal role in shaping the available coverage options and ensuring consumer protections.

One essential framework is the implementation of the Affordable Care Act (ACA), which mandates that all health insurance plans in the marketplace must adhere to specific consumer protections.

These mandates include coverage for essential health benefits, such as preventive care, mental health services, and emergency care, significantly broadening access for Kansans.

Moreover, the ACA prohibits insurers from denying coverage based on pre-existing conditions, a critical development for individuals with chronic illnesses.

Additionally, Kansas has opted to pursue Medicaid expansion under the ACA, although as of October 2023, this expansion remains a contentious topic among policymakers.

The state legislature’s decisions directly impact the number of individuals eligible for Medicaid, thus influencing the collective health of the community by either increasing or limiting access to healthcare services.

Future changes to state laws could further modify the landscape, which is why staying informed and engaged in state health policy discussions is crucial for residents.

This dynamic relationship between state legislation and coverage options serves as a reminder for individuals to regularly review their health insurance plans, not only during open enrollment periods but throughout the year.

Understanding the Health Insurance Marketplace in Kansas

The Kansas health insurance marketplace represents a critical resource for individuals seeking affordable health coverage.

Managed by the federal government through HealthCare.gov, this platform allows residents to compare various health plans side by side, assess coverage options, and find out if they qualify for subsidies that could significantly lower their premium costs.

The marketplace is especially vital for those who do not have access to employer-sponsored insurance or Medicaid coverage, presenting a wealth of opportunities for cost-effective health coverage.

The annual open enrollment period is a key time for Kansans, allowing them to enroll in new plans or make changes to existing coverage.

Outside of this period, qualifying life events—such as marriage, having a child, or experiencing a loss of other health coverage—may trigger a special enrollment period, affording residents another opportunity to obtain health insurance.

Notably, Kansas also offers additional resources through navigator programs and local health advocates who assist residents in navigating the complexities of the marketplace.

These supports are crucial in empowering individuals to make educated choices about their health insurance that suit both their healthcare needs and financial situations.

Decoding the Types of Health Insurance Available in Kansas

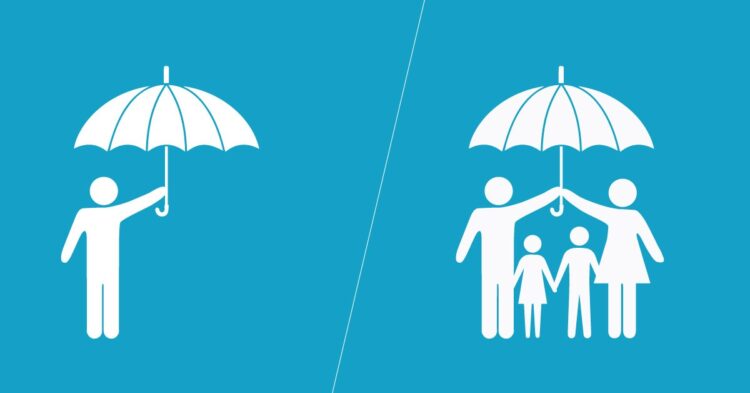

Individual vs. Family Plans: What’s Best for You?

Source: coverfox.com

Determining whether to choose an individual or family health insurance plan is a significant decision for Kansas residents, and it is essential to analyze various aspects of both types.

Individual plans cater to single individuals or couples without children, providing tailored coverage based on their specific healthcare needs and lifestyle choices.

These plans often present lower premiums than family plans and may come equipped with customizable options, allowing for more precise coverage tailored to the individual’s health profile.

On the other hand, family plans encompass a broader range of coverage, extending benefits to dependents, including children and sometimes spouses.

While family plans may come with higher premiums, they often offer family deductibles and out-of-pocket maximums, which can be more economical when multiple family members require medical care.

Evaluating the healthcare needs of all potential enrollees is crucial; families with young children, for instance, may prioritize coverage for pediatric care, vaccinations, and emergency services.

Meanwhile, an individual might focus primarily on preventive services and occasional specialist visits.

Embracing a holistic view of one’s healthcare requirements and financial capabilities ultimately guides users to the most beneficial choice.

Public vs. Private Insurance: Making the Right Choice

In Kansas, residents can choose between public and private insurance, each with distinct advantages and drawbacks.

Public insurance, primarily through Medicaid (KanCare) and Medicare, serves individuals with limited income, seniors, and certain disabilities.

KanCare is instrumental for qualifying low-income households, providing comprehensive coverage options that can significantly alleviate financial burdens associated with medical expenses.

Moreover, KanCare programs include preventive services, routine screenings, and wellness programs aimed at enhancing community health.

Conversely, private insurance encompasses employer-sponsored plans as well as individual health insurance purchased through the marketplace.

These plans offer greater flexibility in provider choice and often cater to a wider range of services. However, private insurance can come with higher premiums and out-of-pocket costs.

Therefore, residents must assess their healthcare needs realistically, considering factors such as physician preferences, frequency of medical needs, and budget constraints.

Striking a balance between affordability, accessibility, and coverage comprehensiveness is key in making an informed decision that aligns with one’s health requirements and financial situation.

Short-Term Plans: A Quick Fix or a Long-Term Solution?

Source: navi.com

Short-term health insurance plans have gained traction in Kansas, especially for those in transitional life stages—like students, recent graduates, or individuals between jobs.

These plans typically offer limited coverage duration, often spanning a few months up to a year, making them appealing for individuals who need a gap-filling solution before securing long-term insurance.

However, it’s vital to be aware that short-term plans do not necessarily provide the same level of comprehensive coverage as traditional health insurance options, often lacking essential health benefits mandated by the ACA.

Kansas residents contemplating short-term plans should meticulously read the fine print, as these policies may exclude pre-existing conditions and may not cover critical services like mental health treatment and maternity care.

While they can serve as a band-aid solution, they may leave gaps in coverage that could lead to significant out-of-pocket costs when unforeseen medical expenses arise.

Therefore, while short-term plans can be a viable option in specific situations, they should not be perceived as a long-term health insurance strategy.

Evaluating one’s health risks, potential medical needs, and budget is critical for determining whether a short-term plan is the right fit.

Key Dates and Deadlines You Can’t Afford to Miss

Successfully navigating the health insurance enrollment process in Kansas hinges on being aware of key dates and deadlines.

The open enrollment period for health plans is typically set annually, during which individuals can enroll in new plans or make changes to existing coverage.

For 2024, this enrollment period runs from November 1 to December 15, a window that residents must capitalize on to secure coverage for the following year.

It’s imperative to mark these dates in your calendar and begin reviewing available options ahead of time, to avoid the rush and potential complications that may arise during the final hours leading up to the deadline.

In addition to the annual open enrollment, residents should also be aware of the special enrollment periods.

These occur after certain qualifying life events, such as marriage, birth of a child, divorce, loss of other coverage, or moving to a new area.

Each of these situations entitles individuals to a specific enrollment period, typically lasting 60 days from the event.

Missing these deadlines could result in a lapse of coverage or extended periods without insurance, leading to unexpected healthcare expenses.

Effective planning and awareness of the enrollment timelines are vital components of securing the appropriate health coverage efficiently and effectively.

Tips for a Smooth Enrollment Process

The health insurance enrollment process can often seem daunting, but with proper planning and preparation, it can be navigated smoothly.

First and foremost, create a checklist of items you will need for the enrollment process, including identification information, income documentation, and details of previous insurance coverage.

Having all documents on hand will facilitate a quicker and more organized enrollment process, minimizing delays that could arise from missing information.

Next, take the time to research different plans available in the Kansas marketplace thoroughly. Utilize state and federal resources to compare plan features, premiums, deductibles, and networks of providers.

Engaging with a certified health insurance navigator or counselor can also provide invaluable assistance and personalized guidance through the enrollment process.

They can help answer your questions, clarify complex terminology, and ensure that you understand the various options available.

Finally, do not hesitate to reach out to your healthcare providers to ensure they accept the insurance plan you choose, as maintaining continuity of care is crucial for ongoing health management.

Understanding Special Enrollment Periods in Kansas

Source: blog.healthsherpa.com

Special enrollment periods (SEPs) are crucial for Kansas residents who experience qualifying life events that necessitate health insurance changes outside the standard open enrollment timeframe.

Events that qualify for SEPs include transitions such as marriage, divorce, the birth or adoption of a child, loss of a job, or changes in residency.

These events grant individuals an extension of 60 days to enroll in a health plan, ensuring that those facing significant life transitions can obtain necessary coverage without unnecessary delays.

Understanding how to navigate these special enrollment periods is essential, particularly since many residents might not be aware of their eligibility for coverage during these times.

Residents are encouraged to keep informed about their rights and options, actively checking in with the marketplace for updates on qualifying conditions.

Additionally, maintaining records of any qualifying life event will streamline the enrollment process and help prevent any denial of coverage.

Ultimately, SEPs are a critical resource designed to ensure that no individual goes uninsured during pivotal times of life—a principle central to the broader objectives of improving health equity in Kansas.

Maximizing Your Health Insurance Benefits in Kansas

Preventive Care: Why It’s a Must for Kansas Residents

Preventive care serves as a cornerstone not just of effective healthcare but also of enhancing the overall health landscape in Kansas.

Health plans governed under the ACA are required to cover a range of preventive services at no cost to the insured—this includes routine screenings, vaccinations, and annual check-ups.

The underlying rationale for prioritizing preventive care lies in its capacity to preemptively address potential health issues before they escalate into more severe and costly conditions.

Kansas residents are encouraged to take full advantage of these services, as they significantly contribute to early diagnosis and management of chronic diseases such as diabetes, hypertension, and cancer—conditions that are prevalent among the population.

Incorporating preventive care into your health routine can yield bountiful long-term benefits. It not only promotes early detection but also fosters a culture of health awareness among individuals.

Moreover, preventive measures can lead to substantial financial savings, as they reduce the likelihood of expensive emergency treatments and hospitalizations.

A proactive approach helps cultivate healthier communities and reduces the overall burden on Kansas health systems.

Ultimately, making regular visits to healthcare providers for preventive care should be viewed not merely as insurance compliance but as a fundamental investment in one’s health and wellbeing.

Understanding Co-Pays, Deductibles, and Out-of-Pocket Maximums

Source: croweandassociates.com

Within the realm of health insurance, it’s crucial for Kansas residents to grasp the terminology and structure surrounding costs such as co-pays, deductibles, and out-of-pocket maximums.

Co-pays refer to the fixed amount that insured individuals must pay at the time of receiving a service—be it a doctor’s visit, a prescription, or a specialist consultation.

While co-pays can vary widely from plan to plan, understanding their implications can help individuals budget more accurately for healthcare expenses throughout the year.

Deductibles, on the other hand, represent the total amount a policyholder must pay out-of-pocket for healthcare services before insurance kicks in.

Higher deductible plans often accompany lower monthly premiums, but this trade-off can lead to unexpectedly high costs in times of medical need.

Therefore, it’s pivotal for residents to assess their circumstances and anticipate their healthcare requirements to select a plan that aligns with their financial situation and expected health needs.

Out-of-pocket maximums act as the cap on what individuals will have to spend during a policy year, seamlessly protecting consumers from catastrophic expenses.

Once this threshold is surpassed, the insurance plan generally covers 100% of covered services.

Knowing these financial components can empower Kansas residents to navigate their health insurance effectively, ensuring both a comprehensive understanding and meaningful engagement with their healthcare plan.

How to Appeal Insurance Denials Like a Pro

Experiencing an insurance denial can be frustrating and disheartening, but Kansas residents should not be dissuaded.

Understanding the appeals process is crucial in advocating for one’s rights and ensuring access to necessary medical services.

Typically, the first step is to carefully review the denial letter from the insurance provider; this document will outline the specific reasons for the denial, whether it be issues related to coverage, billing errors, or insufficient documentation.

Each of these reasons may have actionable steps that can be taken to rectify the situation.

Once armed with this information, individuals should gather all relevant documentation that supports their case, including records of services provided, medical necessity letters from healthcare providers, and any communications with the insurance company.

Organizing this information helps build a strong case for appealing the denial.

Then, the actual appeal process can commence—either through a formal letter or an online submission, depending on the insurance provider’s protocols.

Clear and assertive communication is key; articulating the reasons for appeal using concrete evidence and relevant policy language will greatly enhance chances of success.

Lastly, staying persistent throughout the appeals process is important.

Insurance denial appeals can take time, and follow-ups may be necessary to ensure that requests are being processed.

Kansas residents will find that by actively participating and advocating for their healthcare needs, they can mitigate insurance hurdles and secure the necessary services and treatments they require.