For many traders, the thrill of day trading is almost as nice as the money that can be made from it. It is a very intense experience to do day trading as opposed to traditional stock buying. Things happen fast and the risk of losing a fortune in a matter of minutes can raise the adrenaline like no other job.

These days there is another option, and that is to do cryptocurrency trading. Much like day trading, you are looking to make quick profits off of small margins and sell before those margins go the other way. But, it is a bit different than a beast than traditional day trading.

In this article, we will go over exactly what the differences are between the two so you can decide for yourself what you would rather get into.

Page Contents

Crypto is easy to start

Source: pexels.com

Thanks to Paypal and ApplePay, among other platforms, it is easier than ever to buy some Bitcoin to get started. This is easy and fast and the fees are minimal.

Then when you have some Bitcoin in your digital wallet, you are ready to start buying other cryptocurrencies. Buying bitcoin from paxful.com, ETH, or any other Bitcoin alternative can be done in a matter of minutes.

This is important to know because it’s with these other currencies that you will likely be making your money. Sure, you could focus on Bitcoin and just buy that and make money. The value is still climbing and will likely continue.

But, the margins lie in these other cryptocurrencies and that is why the ease of buying will play a big part in how you make money. Day traders work within these margins so there is more action required on your part.

Traditional day trading takes longer to get started. Not least of which because you have to navigate a lot of regulations that don’t exist with cryptocurrency. You even have to become a professional investor which is not required with cryptocurrency.

Fast profits

Source: pexels.com

Cryptocurrency is not only easier to get started, but it is much faster with the profits. You can start with much less money trading cryptocurrency. If you have $100 burning a hole in your pocket then that can easily get you started making quick profits. If you are very good at seeing trends or understanding other types of cryptocurrency that allow you to see an opportunity when it presents itself then you can compound your money very quickly.

Traditional day trading, on the other hand, will require more initial capital and even a lot of fees to execute your first trade. Then, getting the earnings can take a while. The paperwork required to get started in trading can take quite a while so those potential profits are a ways away when you make the decision to get started. With cryptocurrency, you can have the coins in your wallet within a few minutes of the sale.

In fact, if you are not really sure how much you will enjoy trading, then cryptocurrency is a good way to start since it doesn’t require so much to get started. You can cash out ahead of the game and move on with your life if you feel it isn’t for you. If you put in the time and investment to do day trading then you likely will feel the need to continue because of the sunk cost fallacy even if you don’t enjoy it or feel it is the right thing for you for whatever reason.

Timing

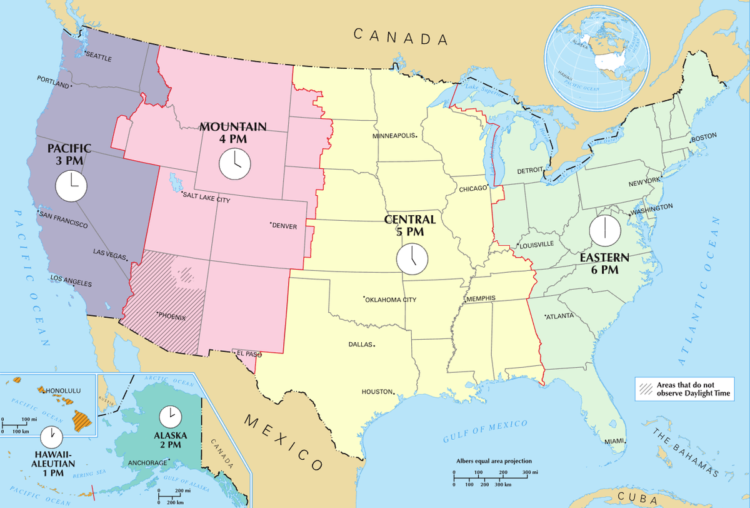

Source: wikipedia.com

It can be considered a positive or negative, but traditional trading happens during certain hours on Eastern Daylight Time. This is good because it can give you a break and not have to worry about trades happening while you rest.

The negative aspect comes when you don’t live in that time zone and don’t want to have to live according to that schedule. You can trade cryptocurrency 24 hours per day since there is no bank or stock market involved. And it is a global currency.

Now, if there is some news that could affect your portfolio and it happens when the market is closed, then this is a big help for you when you don’t live in that time zone. In Europe, for instance, you might be fast asleep when some major event happens that will shake up the markets.

You have the protection of the markets being closed so you aren’t missing out on the opportunity to do anything about it. On the other hand, cryptocurrency is always on and trades can happen at any time. If an event were to happen when you are sleep that can cause a major sell-off of assets, then you would effectively miss out on the chance to protect your assets.

Alternatively, if some announcement is made like Elon Musk buying up $1.5 billion in Bitcoin then that is a great opportunity to buy before things blow up. You would have missed out on that while you were sleeping because there is no schedule for that kind of market.

Day trading gives you control

Source: pinterest.com

Ticking the box for advantages to day trading is the fact that you have more control over making money when you do it. With cryptocurrency, there are not many ways to work within margins like with day trading.

You can be very proactive to make profits where others may not see the angle to work on. Cryptocurrency is usually more cut and dry and everybody seems to be in the same boat. You can acquire a set of skills doing day trading that give you an advantage over cryptocurrency.

Conclusion

One system is not necessarily better than the other. It all comes down to preferences and your personality. You may excel at day trading even with its challenges so in this case it would be better for you but not somebody else, for instance.