In the dynamic and often unpredictable sector of finance, diversification emerges as a fundamental strategy for investors across the spectrum of experience. From those just embarking on their investment journey to seasoned experts navigating complex financial markets, effectively diversifying investments is a critical skill.

Diversification isn’t just about spreading investments to reduce risk; it’s an intricate dance of balancing different asset classes, market sectors, and even geographic regions to create a portfolio that can withstand the twists and turns of the financial markets. This adaptability and resilience are especially crucial in an era marked by rapid technological advancements, global economic interconnectivity, and unforeseen events that can swiftly alter market dynamics.

This comprehensive guide delves deep into the art and science of diversification. It’s designed to demystify the multifaceted strategies underpinning this crucial investment approach, offering clear, actionable insights catering to novice investors and seasoned professionals. By exploring the nuances of short-term tactical adjustments and how they dovetail with long-term portfolio goals, this guide illuminates the path to creating a robust, resilient investment portfolio.

It addresses the complexities of market volatility, providing strategies to navigate and capitalize on the opportunities that arise from market fluctuations. The objective is to empower you with the knowledge and tools needed to craft a diversified investment portfolio that aligns with your financial goals, risk tolerance, and investment horizon, positioning you for sustainable success in the ever-evolving world of finance.

Page Contents

Understanding The Basics Of Diversification

Source: kubera.com

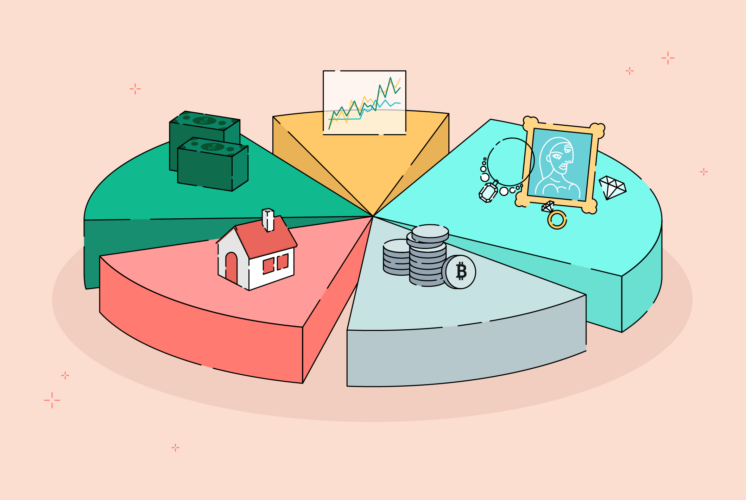

True diversification goes beyond merely scattering investments across various assets. It’s the art of constructing a resilient portfolio to endure market ebbs and flows while delivering steady returns. Diversification involves judiciously blending investments across different asset classes, sectors, and geographical regions. This strategic mix diminishes the risk of severe losses if one investment falters.

It’s a systematic approach to cushion against the unpredictable nature of markets, ensuring that your portfolio is not disproportionately affected by the downturn in a single asset. For assistance, you may consult with experts from CMC Invest or other platforms.

Implementing Short-Term Tactical Moves

Short-term tactical maneuvers are essential tools for agile portfolio management. These involve making calculated, temporary changes to your investment mix to seize emerging market opportunities or to mitigate looming risks. Such adjustments are tactical, not transformational; they are designed to refine your portfolio rather than redefine it.

For instance, strategically increasing your stake in defensive stocks or fixed-income securities can safeguard your investments in a bearish market. These moves are akin to a skilled sailor adjusting the sails to better navigate through rough seas, ensuring the ship stays on course.

Balancing With Long-Term Portfolio Resilience

While the agility of short-term tactics is crucial, the endurance of long-term strategies anchors your investment journey. Building a resilient portfolio over the long haul involves aligning it with your unique risk profile and investment horizon.

This requires a disciplined approach to regular portfolio assessments and adjustments, ensuring that your investment allocations reflect your long-term objectives and adapt to any changes in your financial goals or market conditions.

Assessing Risk Tolerance And Time Horizon

Source: forbes.com

Risk tolerance and investment time horizon are pivotal in tailoring your diversification strategy. These factors dictate how to spread your investments to align with your comfort level and financial targets. A longer investment horizon typically allows for a greater allocation towards higher-risk assets like stocks, given their potential for higher returns over time. Conversely, a shorter horizon warrants a more conservative strategy, focusing on stability and liquidity.

The Role Of Asset Allocation In Diversification

Asset allocation is the backbone of an effective diversification strategy. This process involves dividing your investments among asset categories such as stocks, bonds, and cash. Each category carries its own risk and return profile, and the way you allocate your assets among them plays a decisive role in shaping your portfolio’s overall risk and return characteristics. Strategic asset allocation is about finding the optimal balance that aligns with your investment goals, risk tolerance, and time horizon.

Source: meadmetals.com

Market volatility is an unavoidable aspect of investing, but a diversified portfolio protects against the unpredictable waves of the market. By holding various assets, your investment risk is spread out, mitigating the impact of a downturn in any single asset class. This diversification ensures that you are equipped to weather market storms and positioned to take advantage of the recovery phases.

The Importance Of Regular Portfolio Review And Rebalancing

Maintaining diversification efficacy necessitates regular portfolio reviews and rebalancing. As markets fluctuate, your initial asset allocation can shift, potentially skewing your portfolio away from your desired risk level. Periodic rebalancing is critical to realign your investments with your original strategy and risk appetite. It’s a proactive measure to ensure your portfolio aligns with your long-term financial objectives.

Understanding And Leveraging Different Investment Vehicles

Navigating the array of investment vehicles available, such as mutual funds, ETFs, and individual stocks, is key to building a robust portfolio. Each of these vehicles offers varying degrees of diversification and carries unique characteristics. For instance, mutual funds and ETFs can provide broad diversification across a range of assets in a single investment, making them invaluable tools for achieving widespread market exposure.

Diversification Across Geographies And Sectors

Expanding your investment horizon across different geographies and sectors is another strategic layer of risk mitigation. This approach reduces your portfolio’s dependency on the economic dynamics of any single country or the performance trajectory of a particular sector. Moreover, international diversification opens doors to growth opportunities in different markets, potentially boosting your portfolio’s growth potential.

Conclusion

Achieving proficiency in diversification is akin to navigating a ship through the ever-changing seas of the financial world. It requires a deft blend of short-term tactical acumen and long-term strategic foresight. By adopting these diversified approaches, you equip yourself with the tools necessary to withstand the tumultuous waves of market volatility and harness their energy to propel you toward your financial goals.

The true power of your investment portfolio stems from its composition – a symphony of various assets, each playing its unique part, but when combined, creating a harmonious and resilient whole. This strategic orchestration ensures that your investments are not merely a collection of assets but a unified force working in concert to realize your financial dreams, providing both growth and stability regardless of the market’s ebb and flow.