At the awful moment when you realise your car is definitely not where you put it, the last thing on your mind is whether you are fully insured. For those panicky moments, we explore when your insurance does and does not cover a stolen car.

Page Contents

What won’t cover theft

source:safeguardme.com

First of all, there are two common types of auto insurance that will not pay when your car is stolen:

Liability – this one is basic insurance for your vehicle. It indemnifies you against damage you may cause to other drivers and their property only.

Collision – this is designed to meet your own costs of repair from an accident, but not the costs of the other vehicle.

Comprehensive covers theft

source:autoinsurancevegas.com

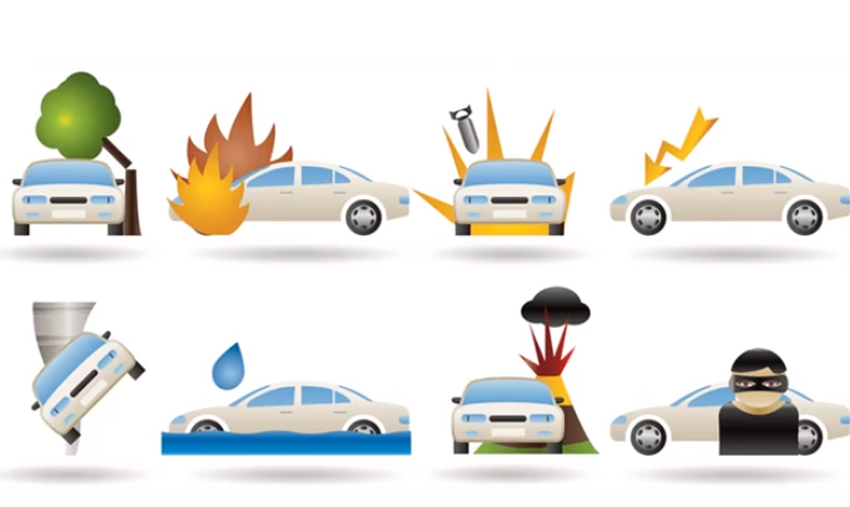

The only type of insurance that will protect you if your car is stolen is called Comprehensive, Comp, Other than Collision, or Fire and Theft. Its purpose is to pay for any damage that is not caused by having an accident, such as theft of the car or car parts, vandalism, or a branch landing on the roof.

Comprehensive is cheaper to buy than liability or collision cover. According to insurance.com, the average driver spends $192 on annual comprehensive. Of course, this varies depending on the state where they live and the actual cash value of their car. The actual cash value is the value minus depreciation.

For example, the insurer values your car at its actual cash (depreciated) value and you decide the size of your deductible (what you will pay). If the depreciated value is $9,000 and your deductible is $1,000, then the insurer will pay $8,000 to compensate for the theft.

Some common mistakes

Some people think if their vehicle is stolen from their own driveway, it is covered by their home policy. This is not the case.

source:thebalance.com

If personal items are stolen from your car, these are not insured by your auto policy. They may be come under your homeowners, condo or renters insurance. It is worth checking “off-premises coverage” for personal property, such as phones or laptops that you carry around with you.

Your comprehensive policy will pay for installed car parts, but may not cover custom car parts that you have added.

If you have had a rental car stolen, you will not get your car fees back unless you added rental reimbursement to your policy.

Don’t become a statistic

During 2016, around 766,000 cars were stolen all over the US. The top three cars, in order of preference, were Honda Civic, Honda Accord and Ford pickup. If you happen to drive one of these – or you just love your car – you might want to check your cover or you can click here and get some extra insurance.