The best auto insurance will always be the one that guarantees the complete coverage in case of an accident or any unforeseen situation. Before purchasing or renewing car insurance, it is suggested to read these tips that help you choose the most suitable one according to your needs.

Securing a good should not be synonymous with spending, but rather the opposite should be considered an investment since the insurance seeks to respond to unforeseen situations such as shocks, theft and even possible damage to third parties. To choose the best insurance information is essential.

Here are the 5 questions that anyone should answer to make sure that the insurance they are looking for fits their needs:

Page Contents

1. How to find the best car insurance?

source:getabusinessinsurance.com

When choosing insurance, it is always advisable to compare the characteristics of the coverage of the different companies available in the insurance market. There are plans that cover 100% of the insured capital, that is, the total value of the agreed vehicle in case of an accident or complete accident. Furthermore, it is good to point out that besides having insurance, contacting a lawyer in case of an accident is crucial, according to Rocky McElhaney Law Firm.

In addition, it is essential to have an appropriate insurance agent or broker to advise you correctly about the plan’s coverage. The insured has the freedom of choice of an agent or insurance broker of his trust.

2. What are the types of coverage?

In the insurance market, there are various types of coverage to insure the car. They are quoted according to the model, year and capital of the vehicle to be protected. In addition, the market plans are detailed according to 3 types of coverage:

Insurance Against All Risk: Covers total and/or partial damage caused by fire, explosion, or lightning up to 100% of market value. It also covers the theft of the total vehicle or its parts, material damage caused by accidents. It is the most expensive option, but in return, you will receive compensation for all coverages.

Third-Party Insurance or Civil Liability: In this case, it covers the damages inferred to third parties as a result of the driver’s civil liability.

Partial Plan Insurance: It is a plan that partially covers the damages, sometimes 80% or 75% of the total loss, and in this way, it is a cheaper policy. A franchise can also be applied, which further lowers the cost of the policy. Get a car insurance estimate from Motor1 to make sure you are getting the very best deal when you start shopping around.

3. What does Insurance Assistance include?

source:newaygocountytowing.com

No matter how much insurance is contracted, if the helpdesk is deficient or what is needed is not obtained, then it is not the best insurance. There is a range of services that are included in the assistance policy such as: towing, changing covers, battery coupling, fuel replacement service, ambulance, among others.

According to www.general.com, you should take into account the list of workshops with which the insurer works and verify the number of events per year included in the policy.

4. Is it advisable or not to secure the accessories of the vehicle?

There are additional elements that must be taken into account when insuring the vehicle. This is the case of non-factory accessories and must be informed so that they are insured. They are optional elements such as radio (if not factory), tires, xenon headlights, among others. These accessories must be included in the inspection made by the insurer. Some include up to a percentage of the capital of the insured vehicle or an additional premium is added for the accessories.

Therefore, it is essential to stop to think about whether or not to compensate for accessories. However, some insurers can cover the extra items even if they are not declared, but up to a specific amount or a percentage of the capital of the vehicle.

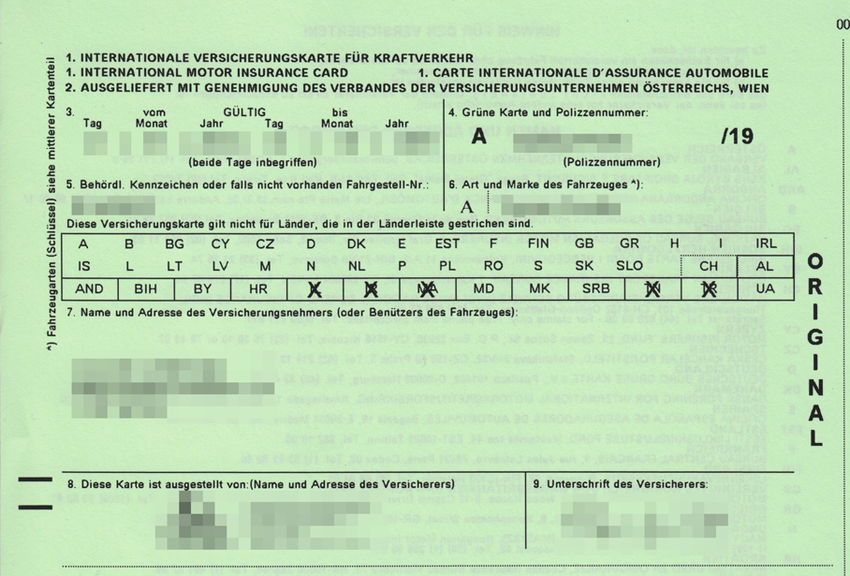

5. With or without a green card?

source:newaygocountytowing.com

When car insurance is contracted, the insurer will ask you if you want the green card that is nothing more than International Civil Liability insurance.

It is advisable to add this insurance in case the person makes trips on international routes. This insurance protects the person from material and personal damages caused to third parties in the event of a traffic accident on trips to Argentina, Brazil, and Uruguay.

If you do not hire the policy, you can request the green card according to the number of travel days required. It is essential to keep in mind that it must be processed every time the border is crossed unless it is already included in the policy with annual validity.