Are you interested in knowing all about the role of payment gateway in India? If yes, then you’ve come to the right place!

A lot has changed in the last 3-4 years. People all across the planet are shifting towards online platforms. From ordering gadgets online to buying groceries online, the eCommerce market in India is booming. This has completely changed the payment landscape in India. Now, who wants to carry cash when they can make a payment online using their phone? Not only is it safe but also convenient. Statistically speaking, around 79% of the Indian population prefers third-party apps to make payments while 52% prefers UPI mode.

To rewind the journey of cash to e-cash, the government of India is working hard to make India a cashless country or one step ahead in Digital India. So, being a merchant in India, it is necessary for you to have digital payment modes. That’s where the role of the best payment gateway in India comes into the picture.

The use of online wallets is popular among the citizens of India.

Page Contents

What is Digital Payment?

Source: biocatch.com

As the name implies it is the procedure where people buy and sell goods without the involvement of any kind of cash. The process happens via electronic medium. Digital payments come in a variety of forms and mechanisms. Bank cards, online banking, e-wallets, online payment apps, the Unified Payments Interface (UPI) system, and mobile banking are just a few examples.

However, UPI model is gaining a lot of attention in India as there is no need for an account number and IFSC code. One can easily transfer payment to another account as long as they are aware of the UPI id or number.

What is the Role of Payment Gateway?

Source: razorpay.com

A payment gateway is critical for an online store because it is a method for accepting transactions on a daily basis. A payment gateway helps with a variety of responsibilities in addition to receiving an unlimited number of payments securely, promptly, and easily.

It encompasses everything, from preserving consumer information for future tracking to enhancing customer happiness through quick payments. Since a payment gateway’s primary function is to credit checks for both you and your clients, an internet store would be worthless without it. Not only does the payment gateway streamline the process of receiving and sending money but it also lets the merchant know about the restriction of transaction. Further, it sends the confirmation receipt to both customers and merchants about the transaction.

Above all, it offers top-notch security, there is a surety that no data will be leaked or stolen during the transaction process.

Moreover, the role of payment gateways is as follows:

- Protected and Secured Payments:

Payment gateways are so encrypted and secured. So, they protect the sensitive and confidential data of customers like credit card numbers etc, from online theft. - 24/7 Store:

The store remains open for 24 hours. So, the customers can buy anything at any place and from anywhere. - Shopping Cart Convenience:

The payment gateways help the customers with carts to deliver a better and complete shopping experience. - Tracking abilities:

You can keep track of all the transactions in a single place only. Whether it’s payment reconciliation or approved transactions, you can manage everything from a single dashboard. - Multiple Ways of transactions:

Your customers can use a debit card, credit card, UPI, net banking and international cards to make a purchase from your website. - Multiple Device friendly:

A payment gateway offers a smooth payment experience to its customers, whether it’s on a laptop, mobile, desktop or tablet. - Quick Transaction Processing:

Payment gateways are much faster as compared to manual processors. Your customers can buy without any issue of waiting in the long queues. - Combined Payments & Settlements:

All the efforts of reaching out personally to the banks lessen by combining with payment gateways. Because the payment gateways take all the required load on your part so that you can totally concentrate on other things. - Payment Switch

A payment switch handles all of the details of a transaction. The payment switch is a versatile entity that accepts payment requests from payment gateways and initiates transaction procedures.

Benefits of Employing the Payment Gateway in India

You will need a payment gateway in India apart from the kind of business you own. From an online clothes store to a SaaS-based company, everybody needs a payment gateway in India. They are the pillar of new digital India. But the doubts must be rising in your head about its popularity.

So, to clear all your doubts we are listing out the benefits of payment gateway in India and why businesses should have it.

1. Fast Transaction

Source: helcim.com

The very benefit of using a Cashfree payment gateway is fast and secure transactions. Businesses don’t have to wait around days for their payment to get credits. The whole process is fast and takes around 1-3 minutes. The technology used in the payment gateway is 50 times faster than the normal procedure.

Even while making cash payments, people took more than minutes to make payments since the process involves looking for cash, counting the cash multiple times, and then handing it over to the merchant. The merchant will then again count it before handling the bill or item.

Payment gateway works as the foundation for successful eCommerce stores.

2. Lower Set-up Costs

There is this misconception among many traditional brick-and-mortar store owners that setting up a payment gateway in India will require a large amount of money and effort. That’s why they don’t put effort into digital employment. However, this all is bogus. Most of the reputed payment gateway in India offer affordable prices to businesses. Further, sometimes they don’t even charge setup fees. Moreover, one can easily integrate a payment gateway with other applications when the business picks up.

3. Enhanced Customer Experience

Source: cio.com

The other benefit offered by the payment gateway in India is the better customer experience. More than anything else, customers love times and that’s why the payment gateway world is a magic wand for business. They reduced all the unnecessary wastage of time. Customers don’t have to wait around to get payment approved. The whole procedure is fast and other than this, the payment gateway is secure which is another reason why customers love it.

4. Global Payments

Other than this, a payment gateway helps businesses in India to receive payment from any part of the world. No need to restrict your business wings when the whole world is your store. By employing a payment gateway, you not only accept international currency but can use language too for a better checkout experience.

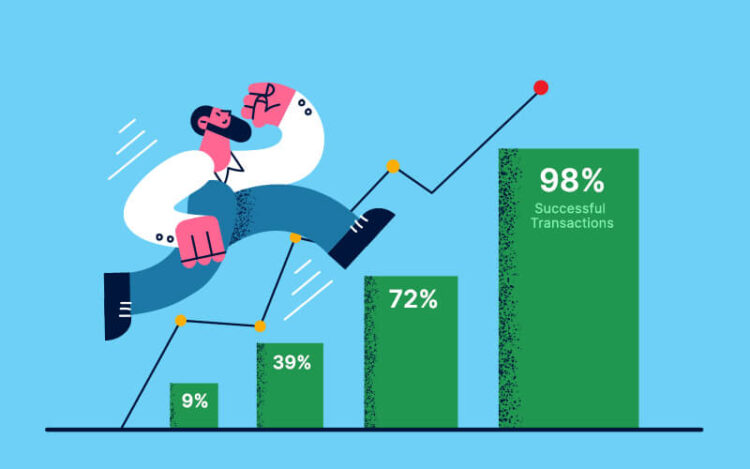

5. HighTransaction Success Rate

Source: business.paytm.com

Payment gateway in India keeps the business on top of declined transactions and offers a high success rate. With different payment modes like UPI, QR codes, debit cards, net banking, credit cards etc, customers today have many options. And the best part is the turnaround time is quite low. The whole processing time is quite less. Having multiple payment options simply improves the transaction success rate of the business as there would be options for people if they face any kind of difficulty.

6. Automation

Further, the other benefit of employing a payment gateway in India is the whole process is fully automated. You don’t have to hire someone specialized in handling payment gateway as the system will work on its own. Since the process is fully automated, the chance of error and mistakes is less compared to the conventional payment methods.

7. Fraud Detection Techniques

Source: anura.io

Fraudulent activities can happen to anyone and online stores are no exception. After the lake happened in multi-dollar companies, online businesses will get worried sick about the payment and security. That’s why all the payment gateway in India comply with the PCI-DSS standard that helps businesses from falling into fraudulent traps. Further, they allow data encryption too. It means all the data is safe within the payment gateways.

8. Increase Cash Flow

The amount received from the payment gateway gets credited to the merchant’s account within 2-3 days. This simply means businesses don’t have to wait for their hard-earned money and based on the cash available they can plan out the future strategies for the business to increase the revenue.

9. Reporting and Payment Reconciliation

Ssource: vinculumgroup.com

Payment reconciliation is basically the bookkeeping that compares the business expenses. At the end of the day, you want a dashboard from where you can keep an eye on the payment you have made, the payment you have received, declined payment, and all. Without it, it will be difficult for you to manage all the things. The best payment gateway in India comes with a dashboard where you can check transactions, settlements, etc.

That’s all! Digital payment modes have changed the whole concept in India. People now can walk freely on the road without the fear of getting robbed. Payment systems or contactless payments have drastically altered India’s economic situation and the way we conduct business in our daily lives. Becoming cashless is simple, painless, and provides ‘clean’ transactions with a complete record.