Let’s start this text by saying that the process of applying and obtaining any mortgage is not an easy one, primarily if you are in the “self-employed” category. However, fear not, although you found yourself in this situation, you might still be eligible for getting one. Now, keep in mind that the entire things are diverse and more difficult – and you must collect a wide range of documents, and, of course, you need to invest your time.

However, there are some things that you can do that will make everything easier for you. First of all, you should learn everything there is about mortgages for self-employed individuals, and second, you should also follow some basic steps that can aid you quite a lot. The text below will feature a guide for obtaining a loan and some tips on how you can find one. Let’s take a closer look at the article:

source:newbury.co.uk

Page Contents

What Are The Steps That I Should Take?

As mentioned at the beginning of the text, this process is, let’s say, one with a lot of layers – and it is also time-consuming and complex. But, there are some steps that you should take, ones that will allow you to feel less overwhelmed and stressed. The steps that need to be remembered include:

You Need to Collect A Lot of Necessary Documents

source:phamnews.co.uk

Of course, this is normal for any mortgage that you apply for. Collecting the documentation is the most important and critical part of making your finance profile. The company that will lend you the money will probably ask for some documents and they will also want to verify where your earnings come from and how stable it is. Hence, begin with collecting:

– A completed list of revenue tax returns for the last 2 years – some might ask for other years as well. Use 4506 C form IRS to request copies of previously filed tax returns.

– If your company did not file the most recent tax return, you might need a CPA inspected revenue and loss document.

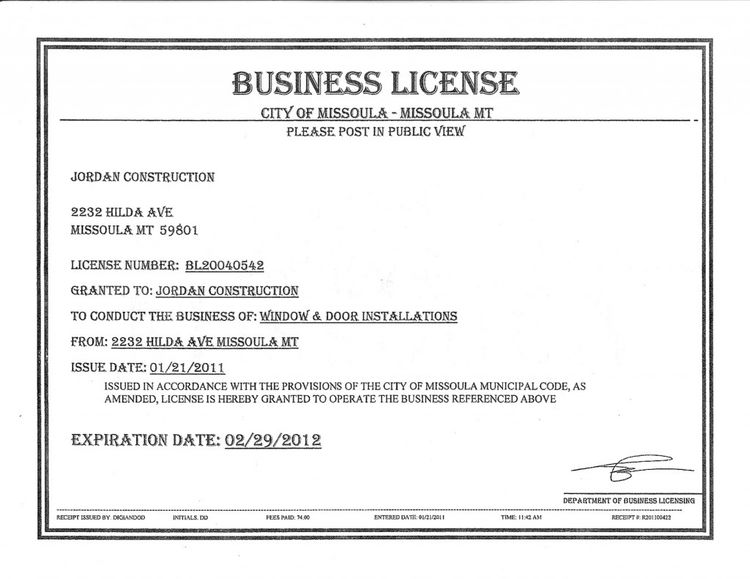

– A copy of your business’ license.

source:total-apps.com

By collecting these documents, the lender can determine what your company revenue is, for the time period of at least 2 years. This evaluation is what will influence and qualify you for a lease if you are an individual that leads a stand-alone business. If you want to see what other documents you might need, you can find out more here.

The Credit Score is Extremely Important

source:cnbc.com

People lending money to business owners will usually ask people if they have a score of at least 620 points. Generally speaking, you might get lucky and obtained the loan with a lower score, however, like everything else, you can improve the chances of getting approved if that number is higher.

Hence, it is important to regularly check your scores, especially because you are self-employed. Also, you should be ready to fix any problems or mistakes on the report you get – this is especially important if you want to maintain a higher score. There are various applications and websites that can make it easy for you to check and maintain the reports you get.

The Assets Owned By You And The Down Payment Amount

source:pxfuel.com

The down payment is also an important thing when people are self-employed. While people who have regular salaries can get a down payment of about 3 to 5 percent, lenders usually do need self-employed individuals to pay a higher down payment. For instance, a down payment that is 15% is thought to be a powerful compensation that can hinder income risks.

DTI (Debt-to-Income-Ratio)

source:creditkarma.com

This is an expression used in the leasing world to describe the combination utilized to figure out if someone has a revenue that is sufficient enough to pay the money back. There are 2 kinds:

-

A Housing Rate

This refers to the new house payment that you will get, split by the steady revenue you have every month. Hence, for instance, if your salary is, let’s say, 10.000 dollars, the amount is going to be 2.500 dollars, which means that the payment will be as high as 25 percent.

-

DTI For The Total Debt

Now, this refers to the new house payment + the non-housing recurring bill, which is distributed by your earnings every month. It includes a wide range of things such as car loans, monthly payments for your credit card, child support, as well as payments on other properties that you own.

What Should I Do To Become an Attractive Candidate?

source:debt.org

If you are well aware that you can make each and every payment, you can opt for some things that will improve your chances of getting approved. These things include:

- Choose to Offer a Higher Down Payment – before the lender even looks at your credit score, you can offer it to them. Hence, the bank will look at you as someone who will be a less risky candidate since people do not walk away easily from a high down payment.

- Have a High Cash Reserve – besides you offering a higher down payment, you should also have a lot of cash that will act as your emergency fund. This will show the lender that you can make the payments each month, even if your business is not doing as well as it usually does.

- If You Have Debt, Pay it – the fewer payments you need to make, the easier everything will be for you. If you have some loans for your house, car, or credit cards, try to clear the debt. This can qualify you for a better loan since you will have steady and higher revenues.

Conclusion

source:myoccu.org

As you can see, the process of applying and being approved for a mortgage in the self-employed world is a long and complicated one. However, if you learn everything there is about it, and if you learn what steps you need to take, you can make the entire process easier, less time-consuming, and less stressful. So, now that you know everything there is, you can start with the first item from this list – which is collecting the necessary documents. If you happen to be still working as a self-employed senior citizen age 62 and older you may qualify for a federally insured home equity conversion mortgage also known as the HECM. This special type of mortgage has limited income requirements and most qualified just off their Social Security alone. Reverse mortgages are comparable to today’s conventional mortgage rates and are increasingly gaining popularity throughout the United States. To get an idea of how much you may qualify for use this free calculator provided by reversemortgageReviews.org