If you’re on a tight budget, you can’t afford to pay a fortune for your daily banking account. And yet, so many of the big banks apply big fees every month. If you’re tired of paying annoying charges and other fees for daily banking tasks, keep scrolling. Here are some simple yet effective ways to save money.

Page Contents

Understand Your Account

source:cnbc.com

Every account comes with unique terms, conditions, and privileges. It’s important you know what comes with yours, so you understand when and how you’ll be charged.

For example, your chequing account likely comes with a set number of transactions a month. Without knowing this number, you could blow past it and rack up huge fees.

But more than that, you need to know what counts as a transaction. Will paying off your credit card online count towards this number? Or do only purchases made in-store with your debit count?

Get to know the fine print behind your accounts, so you’re never surprised by fees.

Use Cash Back in Place of Out-Of-Network ATMS

source:money.usnews.com

With a wallet full of cards and a phone set up for digital payments, there’s no longer a need to keep bills on hand. So when a special occasion requires physical cash — like you want to pick up a souvenir while on a road trip — you end up finding the nearest ATM to get cash.

If you’ve done this recently, you know how expensive this habit can be. Using out-of-network ATMs can cost as much as $7 each time.

Save yourself that $7 by saying yes to the cashier the next time they ask, “Would you like cash back?”. This is a simple way of avoiding ATM fees and getting the cash you need.

Use Your Credit Card More Often

You probably won’t see this piece of advice often, it’s true. Credit cards are a divisive topic in the financial world.

On the one hand, they serve as a safety net while building up good credit. On the other hand, they act as a temptation that convinces you to spend cash you don’t have.

However, if you use them responsibly, you can leverage your credit cards to your advantage.

If your account has a severe limit on transactions, swap out your debit card with a credit card. Just make sure you go online to pay off your balance to avoid late penalties and to protect your credit.

Using your credit card more often comes with another bonus. If you have a card that comes with rewards, you’ll earn points more often.

Consider Moving to a Credit Union

source:money.usnews.com

Even while following these tips, you could still end up spending between $7 and $30 a month for a simple banking account. But that doesn’t mean you’re stuck paying these astronomical charges.

Research the local credit unions in your area to see if you can make the switch. A local credit union provides the same convenient services you expect from the biggest commercial banks but with fewer fees. To find out what it means to be a member of a credit union, learn more from FirstCalgaryFinancial.com about membership perks.

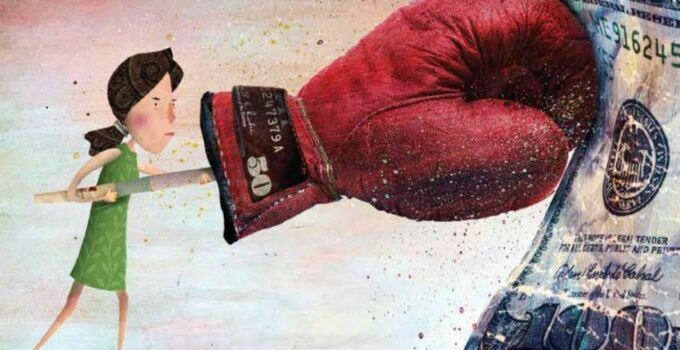

Stop Paying Useless Fees

It isn’t always convenient or affordable to bank with the biggest names in the financial world. They slap fees on everything you do — even if you just want to spend your money!

But that doesn’t mean you’re stuck covering these annoying charges. Get to know your account and consider moving to a credit union. These tips can help you change your habits, avoid penalties, and keep your money where it belongs.