Singapore doesn’t play by the same rules as most property markets. Its land is scarce, demand is consistent, and policy-makers are methodical. This means price dips are rare, and when they do occur, they never last long. If you’re waiting for a market “correction,” you may end up missing the entire opportunity.

Right now, the window is still open. You can still access top-tier projects with capital growth potential, rental yield upside, and prime locations that will become even more valuable once key infrastructure projects complete. But that window is closing fast—and once it does, the next entry point will come with a higher price tag.

The smart money knows this. Institutional investors are already positioning themselves. Local families are upgrading ahead of schedule. Developers are accelerating new launches. The signs are all there. What’s missing is your decision.

If you’ve been on the fence, 2025 could be your last chance to secure property in one of the world’s most stable and profitable real estate ecosystems before the next price wave begins.

Page Contents

Key Highlights

- Land supply is tight, and that supports long-term price growth.

- New developments offer sustainable, smart features that raise value.

- Foreign buyers are returning, increasing future competition.

- Government policies reward serious investors and long-term owners.

- Rental demand remains strong across multiple property segments.

The Clock Is Ticking on Entry-Level Prices

Source: edgeprop.sg

Singapore does not follow boom-and-bust patterns seen in other markets. That’s by design. Government controls and urban planning keep demand steady and supply constrained. As a result, property values usually trend upward—with brief pauses, not crashes.

Ask yourself this: where else can you find such stability, coupled with rental demand and global investor interest?

Prices may look high today, but relative to what they’ll be in two or three years, they’re still fair. When infrastructure upgrades complete, especially around the Cross Island Line and Jurong Region Line, prices in those corridors will not just rise—they’ll reset.

If you’ve waited to enter the market, don’t wait much longer.

Anchor Developments That Lead the Way

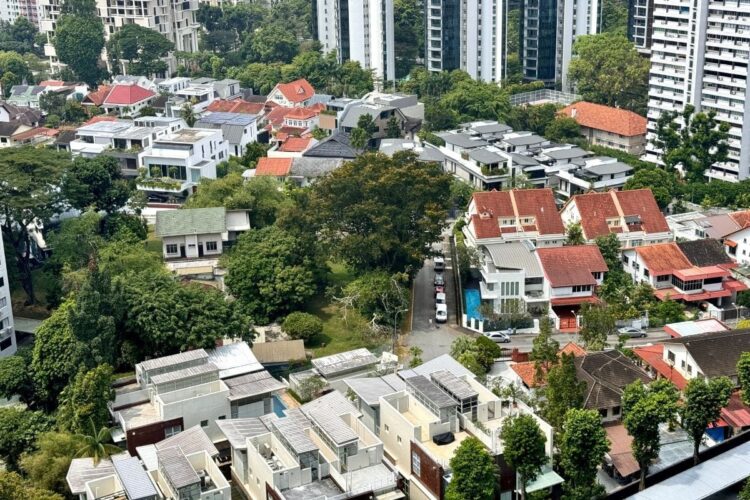

Source: landed7772.com

Developments that are well-located, future-ready, and backed by established developers offer the strongest value retention. One standout example is Lyndenwoods.

This project by CapitaLand is more than a residential address. It represents a complete shift toward smart, sustainable living. CapitaLand is no newcomer. Their track record includes iconic landmarks such as Raffles City and One Pearl Bank—symbols of innovation and architectural discipline.

Here’s what makes Lyndenwoods an investor-safe choice:

- Built for tomorrow’s buyers, with digital integration and eco-conscious designs.

- Strategic location with strong rental appeal.

- Backed by a developer known for long-term commitment, not short-term gain.

In a market where quality matters more than ever, buyers are choosing projects that stand the test of time.

Real Demand, Not Just Speculation

Source: propertyguruforbusiness.com

You’ve heard the phrase “hot market” before. But let’s be clear—what’s fueling Singapore’s property demand isn’t hype. It’s need.

- Upgrading families are moving from HDB flats to private condos.

- Young professionals want access to MRTs, co-working zones, and smarter spaces.

- Foreign talent continues to return post-pandemic, driving rental demand.

This isn’t just one group inflating prices. It’s a diverse mix of real people with long-term needs. And supply isn’t keeping up, because land is limited and approvals are strict.

Now think about what happens when international borders stay open, more expats arrive, and global capital starts flowing in again.

Mid-Tier and Premium Segments Will Move First

Source: shawnkuah.com

It’s a mistake to assume that all property types grow at the same pace. History shows that mid-tier and premium condos lead during a price climb.

Here’s why:

- These segments appeal to a wider group: professionals, dual-income families, and investors.

- Locations near MRT lines, good schools, and shopping hubs carry built-in desirability.

- They are more likely to include smart-home features and sustainable design—two essentials for next-gen buyers.

So when prices shift again, this is where it starts.

In a rising market, not all developments perform equally. Grand Zyon is a strong case study. Developed by CDL and Mitsui Fudosan, it reflects what modern investors now demand: bold design, future-proof infrastructure, and a community-focused vision.

Why does it matter?

- CDL is known for award-winning projects and sustainability leadership.

- Mitsui Fudosan brings Japanese precision and a culture-first design philosophy.

- Their partnership blends Singaporean foresight with global execution standards.

Buyers who recognize that early often reap the strongest returns.

Rental Income as a Secondary Stream

Don’t overlook the importance of rental income in your investment strategy. Singapore’s property market supports a vibrant rental segment due to:

- Expats seeking short- to mid-term stays.

- Locals in transition between properties.

- Professionals working near business parks and industrial clusters.

Rental yields in key locations often exceed 3%–4%. In today’s low-interest environment, that’s a strong passive income play. Choose properties with high walkability, amenities, and nearby transport links to ensure consistent demand.

Financing Still Works in Your Favor (For Now)

Source: thelistingcolony.com

Bank interest rates have risen, but mortgage options in Singapore remain competitive. Banks continue to offer packages with long-term fixed rates and stable repayment terms.

If you buy before 2026, you can:

- Lock in current financing terms before further tightening.

- Benefit from tax incentives available for early ownership.

- Leverage lower total cost-of-ownership in the first 5 years.

Financial discipline is key. The earlier you buy, the more room you have to enjoy equity growth and income-generating potential.

Long-Term Urban Planning Makes a Difference

Singapore’s urban design isn’t reactive. It’s forward-planned, reviewed, and refined by public agencies like URA and HDB. They don’t just build homes. They build ecosystems.

Upcoming launches are backed by:

- Green corridors and parks

- Schools, transport, and healthcare hubs

- Mixed-use precincts with business and retail integration

Investors who align with the government’s Master Plan often find themselves holding property in districts that grow faster and hold value longer.

Final Decision: Now or Never?

Every market has turning points. Singapore’s next shift is around the corner. If you’re waiting for prices to drop—you’ll likely be waiting a long time.

What you can do now:

- Review upcoming projects and shortlist units with future-proof layouts.

- Choose developments led by high-trust developers with a sustainability focus.

- Act before 2026 when land pricing and construction costs could rise again.

Singapore won’t stay still. Neither should your investment strategy.