Saving money is not always easy, but as the saying goes – save money when you have money. It’s a lot easier to put a few dollars on the side when your paycheck is good and to have your savings waiting for you on rainy days.

However, it’s not always easy to be smart with money. We see something we want and we try to get it. More often than not buying ourselves something pretty gives us the strength to keep working.

If you want to keep your finances in check and learn how to be smart and always have a few extra dollars, this article is for you!

Page Contents

Create a budget

source:start-up-booster.com

It’s easy to lose track of how much you are spending when you don’t keep track of it. Write your expenses down or use an app to track where your money is going.

After a month check your habits and set a budget. For example, when you go out with friends, it’s really easy to forget to pay attention to the money you are spending. Set a budget per night before you go out and stick to it.

You don’t have to deprive yourself of the things you like. You can still get the things you enjoy, but try to get them once per month, not 3 times per week, especially if it comes to things you don’t really need.

Earn more, save more

source:medium.com

When we get a raise the first thing we do is plan where to spend that money. How about this, try saving all, or at least 50% of that money. You were able to live without that sum till now, right?

It’s actually easy to save a lot of money and invest in something big if you pay attention to the small sums and focus on your large goals.

Beware of expensive habits

Is there anything you spend a lot of money on? The easiest way to keep your finances in check is to follow those habits. Once again, this does not mean that you will have to stop doing the things you like to do. Go out, party, buy that perfume.

Just, have a budget for those things. At the beginning of every month put aside a sum of money for just fun things. After a while, you will start spending less of that money and save more when you realize you can create a balance between spending and saving. If you find yourself in a financial emergency, getting a title loan from a reputable lender like 800loanmart.com can help tremendously as long as you pay back the loan in full quickly.

Pay your debts

source:clovekvtisni.cz

If you have student debt or anything like that, it will suck your money away and you won’t be able to save any money.

If you cannot afford to pay off your debts, you should consider taking a loan with a low-interest rate. There are a lot of different types of loans that could work for you. Even though this seems like patching one hole up to open up another it’s not the same.

When you borrow money from a bank or a lender, you will be able to control the terms, get a lower rate and create a plan that you will be able to follow and put money on the side as well.

Think about your goals

What are you saving the money for? Do you want to buy the house you’ve always wanted in Cape Coral, Florida? Or do you want a new ride that everyone will envy?

Depending on your goal and how fast you can reach it, make the plan for your finances. If you want to buy a new apartment, first think about the location and the size of it. Find out the price for that apartment. Now, try to write down the money you can put aside and calculate how long it would take you to save enough money to buy it. Will a loan make a difference?

There are a lot of things you need to think about, but when you focus on your goals and why you are doing all this, it’s going to be easier to keep your finances in check.

Keep track of your income

source:business2community.com

If you work more than one job, or if you have several part-time gigs, keep track of it. It’s easy to just spend when you notice more money on your credit card than you did the day before.

If you get paid every week or every two weeks, it’s a lot easier to spend more money than when you get paid once per month. Because of that, try and keep track of every penny that you earn and make your budget for other things depending on that.

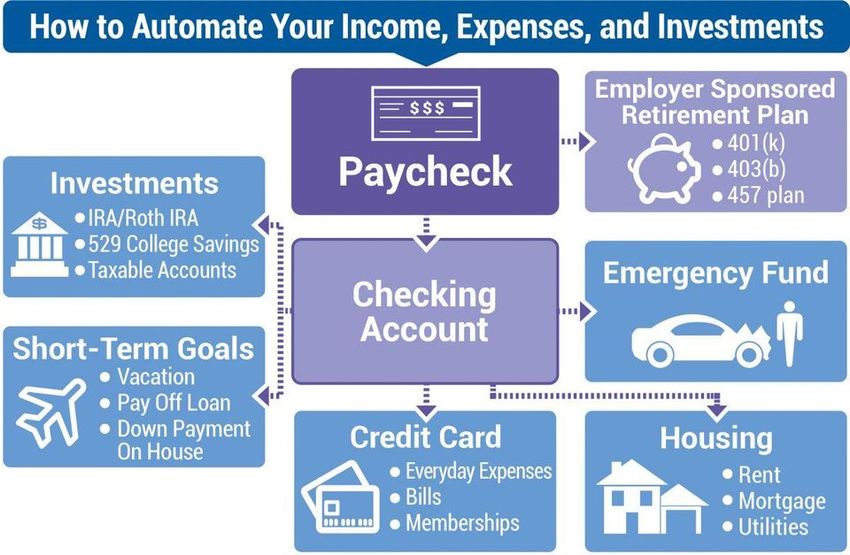

Automate your finances

source:forbes.com

If it is hard for you to put money on the side because there are extra expenses every month, one thing you can do is to automate your finances.

Schedule monthly transfers to an investment account you have or an extra credit card that will be used for emergencies only. That way you won’t have to put cash on the side and “losing” that money will be easier.

When you check that account after a few months, you will be surprised how much you managed to save.

Get everyone involved

Have your friends and family help you reach your goal. Let them know that you want to keep track of your finances and that you want to save some money. And ask for their help. When you’re out with a friend and want to buy something you really don’t need, your friend can remind you of your goals.

This will benefit everyone. When the people around you remind you to save a few bucks, they will start doing that as well. It’s easier when you work out in pairs, why should saving money be any different?

Try to spend more time with ambitious people who know how to work with money. You can learn more than a few things from them and they can give you their secrets of success.

Don’t expect to have thousands of dollars on the side after a few weeks. Everything takes time, so just be patient and remember why you are doing this.

By changing your mindset it will be easier for you to learn how to keep track of your finances and how to improve yourself in other parts of your life as well.