Form 16 is a document given by employers to employees as proof of depositing their TDS/Tax requirements. It is, therefore, one of the most essential documents and is issued in accordance with the provisions of the 1961 Income Tax Act.

Form 16 is presented in two parts – A and B. Each serving a different purpose.

source:blog.indialends.com

Page Contents

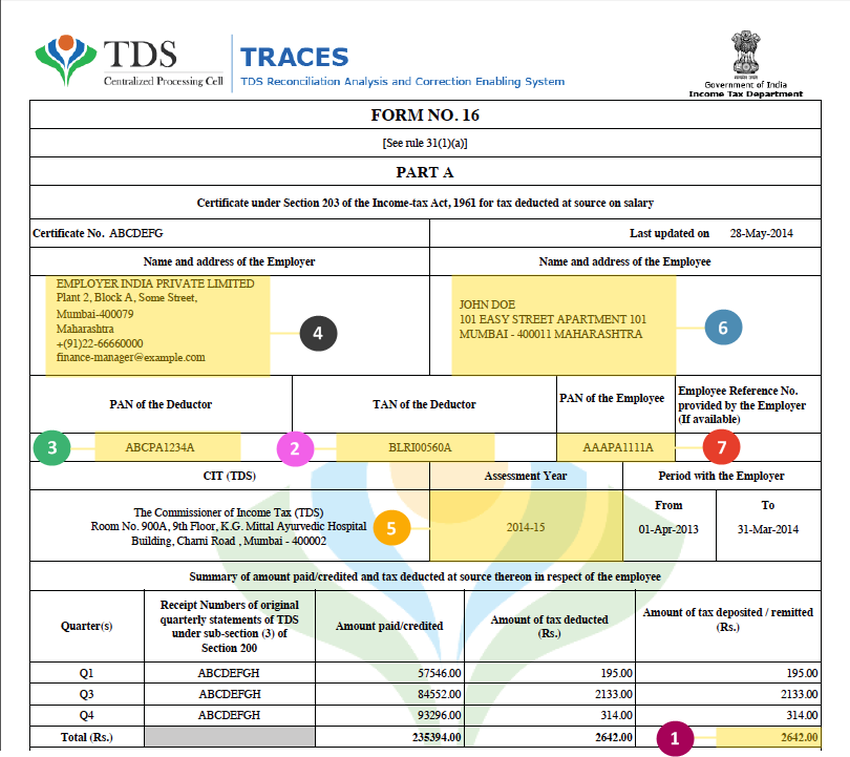

Form 16A contains:

Employer details, their taxation digits (TAN and PAN), employee’s PAN and a summary of tax from the employer.

Form 16B contains:

All deductions such as life insurance premium, pension fund contribution, interest on education loan…and so on and so forth.

What’s the difference between Form 16, 16A and 16B?

source:authbridge.com

In summary, it is a difference between the source of origination.

Form 16 is given by the employer as a tax deduction proof.

Form 16A is given by financial institutions, people who have deducted tax at source – for example, fixed deposits, mutual fund houses… etc.

Form 16B is issued for tax deducted through the sale of the property, like a house. This is issued from buyer to seller as the mandate is 1% of sale value. 16B ensures the buyer has deposited tax. Read here to know more about Form 16

As a conclusion, we must add that even if you change employers, you must collect all your Form 16’s since you’d need it to submit for tax filing.

Who is eligible for Form 16?

Any person who is/has been employed and has had their TDS deducted.

Why is it important for an employee to get form 16?

Since Form 16 is related to Income Tax, it is important to get this document because it will help you quicken the Income Tax return process if you’re digitally filing your return.

How do I download Form 16?

1: Visit https://www.incometaxindia.gov.in.

2: Under Forms/Downloads you’ll see the option for Income Tax Forms

3: From the list, click Form 16

4: Choose your format PDF or Fillable Form.

5: Download the form in the format you’d prefer

What are some important allowances on Form 16?

- HRA (House Rent Allowance)

HRA is a component of salary to meet rent expenditure. It’s received from the employer and is 40-50% of the salary break up

- Conveyance allowance

This is paid as a compensation to employees for expenses they pay to travel to and from work.

- Medical allowance

This is paid by the company to cater to employee’s spending on medical treatment and medicines.

- Education Cess

This is a contribution made towards the development of Secondary and Higher Education development. All taxes in India are subject to 4%

How do I file my ITR from Form 16?

source:office.msubaroda.ac.in

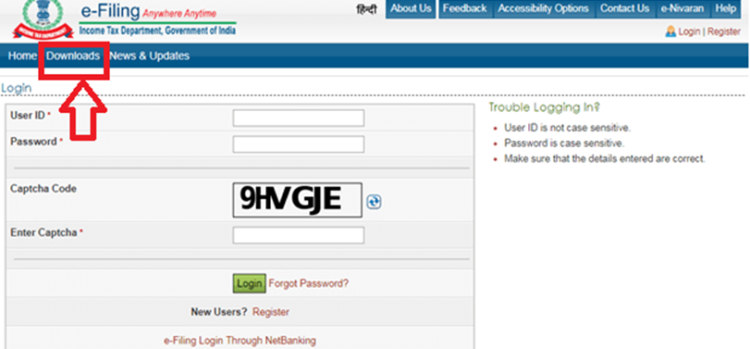

This process is now digital and possible through https://www.incometaxindiaefiling.gov.in/home.

To begin filing, register yourself on the website with your User ID which will be your PAN number.

Then, study the tax credit statement in the Form 26AS for the financial year you’re filing. Within this you’d see the taxes deducted by the employer and deposited to the government.

To begin the ITR, download the ITR form that is applicable and open the Return Preparation Software. This will calculate the tax payable to you. Once you validate it, it’ll confirm all the information you’ve entered/has been entered.

Save this file as an XML and upload this return on the portal; then, it’ll ask you to Digi sign the document – do that and complete the process. Once the system confirms successful e-filing, you will get the acknowledgement from the ITR department.

If this all seems complex, we advise you to go to a CA who know the process better and help you in a better way. To Know more Check this website for ITR Information.

We hope this guideline has been helpful in informing you about what Form 16 is, the difference between 16, 16A and 16B and finally, how to file your ITR.